Urban Planning and Its Influence on Property Value

Urban planning plays a pivotal role in shaping the physical environment of cities and regions, a process that extends far beyond aesthetics to profoundly impact the valuation of real estate. The strategic decisions made in urban planning — concerning infrastructure, zoning, public spaces, and community development — create a ripple effect that directly influences the desirability, functionality, and ultimately, the monetary worth of properties within a given area. Understanding this intricate relationship is crucial for homeowners, investors, and anyone interested in the dynamics of the housing market.

The Core Principles of Urban Development and Property

Urban planning is a comprehensive process that guides the growth and transformation of cities and towns. It involves making decisions about land use, transportation, infrastructure, and the provision of public services. These decisions are not arbitrary; they aim to foster sustainable communities, enhance quality of life, and support economic vitality. From a property perspective, effective urban development can create environments that are more attractive for residential, commercial, and industrial use. Conversely, poorly planned areas may face challenges that detract from property desirability and value over time.

How Zoning and Land Use Regulations Impact Housing and Investment

Zoning ordinances are a fundamental tool in urban planning, dictating how land can be used within specific areas. These regulations classify land for residential, commercial, industrial, or mixed-use purposes, and also specify building heights, density, and setbacks. For property owners and investors, zoning is a critical factor because it determines the potential uses and limitations of a parcel of land. A change in zoning from residential to commercial, for instance, can significantly increase a property’s investment potential and market value, reflecting its newfound capacity for higher-value development or different types of structures.

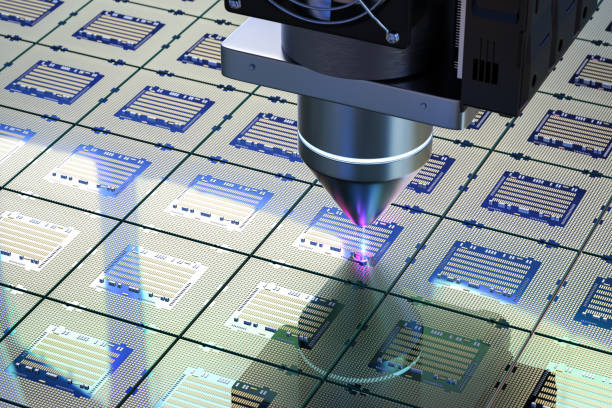

Infrastructure and Its Role in Property Valuation

The presence and quality of infrastructure are direct drivers of property value. This includes essential services such as roads, public transportation networks, water and sewage systems, and utilities like electricity and internet access. Areas with well-developed and maintained infrastructure tend to command higher property values because they offer greater convenience, accessibility, and reliability for residents and businesses. Investments in new infrastructure projects, such as a new transit line or highway expansion, can open up previously less accessible areas, stimulating new development and increasing the valuation of existing land and buildings.

Residential and Commercial Structures: Market Trends and Assets

The interplay between urban planning and the market for residential and commercial structures is dynamic. Planning decisions can influence the supply and demand for different types of properties. For example, policies encouraging high-density residential development near urban centers can affect the availability and pricing of housing. Similarly, designated commercial zones with supportive infrastructure attract businesses, creating employment opportunities and increasing demand for both commercial spaces and nearby residential properties. These trends are closely watched by those looking to acquire assets in strategic locations.

Global Perspectives on Land Ownership and Planning

Urban planning principles and their impact on land valuation and ownership are observed globally, though specific approaches vary by country and region. In many global cities, strategic planning aims to attract international investment, foster innovation hubs, and create vibrant urban cores. These efforts often involve significant public-private partnerships and master-planned communities designed to offer a high quality of life and business opportunities. The success of such planning initiatives is frequently reflected in the appreciating value of urban assets, drawing in both local and international finance for acquisition and development portfolios.

Urban planning initiatives directly influence property values through various mechanisms. For example, investments in public parks and green spaces often lead to an increase in nearby residential property values due to enhanced aesthetic appeal and recreational opportunities. The revitalization of waterfront areas through urban design can transform undervalued industrial land into prime residential and commercial real estate. Similarly, the establishment of pedestrian-friendly zones and mixed-use developments in city centers can boost commercial property values by increasing foot traffic and consumer engagement. These types of planning interventions demonstrate a clear link between intentional urban design and tangible economic benefits for property owners.

Future Trends in Urban Planning and Property Portfolios

Looking ahead, urban planning continues to evolve, incorporating concepts like smart city technologies, climate resilience, and equitable development. These emerging trends are likely to further influence property market dynamics. For property portfolios, understanding these future directions is key to making informed investment decisions. Planning for sustainable communities, integrating green infrastructure, and leveraging data to optimize urban services can enhance the long-term value and attractiveness of properties, aligning with evolving societal priorities and environmental considerations. This forward-looking approach to planning is essential for sustained growth in urban assets.