Financial Literacy for Modern Life

Understanding personal finance is a fundamental skill that empowers individuals to make informed decisions about their money. In today's dynamic economic landscape, financial literacy is more crucial than ever, extending beyond basic budgeting to encompass investing, managing debt, and planning for future security. Developing a strong grasp of financial principles can lead to greater economic stability and the ability to achieve long-term goals.

A solid foundation in financial literacy helps individuals navigate the complexities of personal wealth management, from daily spending habits to significant life investments. It involves comprehending how money works, how to earn and manage it, and how to use it effectively to build a secure future. This knowledge is not just for experts; it’s a vital tool for everyone seeking to improve their economic well-being and achieve their aspirations in a globalized economy.

Understanding Personal Budgeting and Savings

Effective budgeting is the cornerstone of personal finance. It involves tracking income and expenses to ensure that spending aligns with financial goals. Creating a budget allows individuals to identify areas where they can save money, allocate funds for essential needs, and set aside resources for future objectives like a down payment on a home or retirement. Savings, whether for emergencies or long-term growth, are critical for financial security. Regular contributions to a savings account, even small amounts, can accumulate significantly over time, providing a buffer against unexpected expenses and a pathway to larger financial endeavors.

Navigating Debt and Credit Responsibly

Debt can be a valuable tool when managed wisely, such as for purchasing a home or funding education, but it can also become a significant burden if not handled carefully. Understanding different types of debt, including mortgages, student loans, and credit card balances, is essential. Responsible credit management involves making timely payments, keeping credit utilization low, and regularly checking credit reports. A strong credit history is vital for securing loans, renting properties, and even some employment opportunities, reflecting an individual’s financial reliability and overall security.

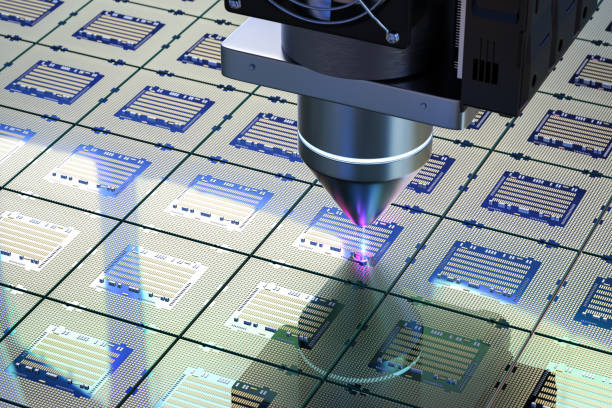

Exploring Investment Opportunities and Risk

Investing is a powerful way to grow wealth over the long term, but it inherently involves risk. It’s important to understand various investment vehicles, such as stocks, bonds, mutual funds, and real estate, and how they align with personal financial goals and risk tolerance. Diversification, the practice of spreading investments across different asset classes, is a key strategy to mitigate risk. The global economy and financial markets are constantly evolving, presenting both opportunities and challenges for investors. Staying informed about market trends and economic indicators can help in making more strategic investment decisions for future growth.

The Role of Banking and Digital Finance

Banking services are fundamental to modern financial life, providing secure ways to manage daily transactions, save money, and access credit. Traditional banks offer a range of services, but the rise of digital finance and online banking platforms has transformed how people interact with their money. Digital trends offer convenience, often with lower fees, and access to innovative tools for budgeting and investing. Understanding how these platforms operate, their security measures, and the various financial products they offer is crucial for leveraging digital finance effectively in a global context.

Building Long-Term Wealth and Financial Security

Building wealth is a long-term process that requires consistent planning and disciplined execution. It involves not only saving and investing but also making informed decisions about insurance, retirement planning, and estate planning. Financial planning helps individuals define their goals, assess their current financial situation, and create a roadmap to achieve desired outcomes. The ultimate aim is to create financial security, providing peace of mind and the freedom to pursue life goals without undue financial stress. A well-structured plan can adapt to life changes and economic shifts, ensuring a secure future.

Cost Estimates for Common Financial Services

Understanding the costs associated with financial services is a vital aspect of financial literacy. While many basic services are accessible, specific features or premium accounts often come with fees. Comparing these costs across different providers can lead to significant savings and better value. For example, some banks offer free checking accounts, while others charge monthly maintenance fees unless certain conditions are met, such as maintaining a minimum balance or setting up direct deposits. Investment platforms also vary in their fee structures, from commission-free trading to advisory fees based on assets under management.

| Product/Service | Provider Type | Typical Cost Estimation |

|---|---|---|

| Checking Account | Traditional Bank | $0-$15 monthly fee (often waived with conditions) |

| Checking Account | Online Bank | $0 monthly fee |

| Savings Account | Traditional Bank | $0-$5 monthly fee (often waived with conditions) |

| Savings Account | Online Bank | $0 monthly fee |

| Investment Platform | Robo-Advisor | 0.25%-0.50% of assets under management annually |

| Investment Platform | Discount Brokerage | $0 commission per stock/ETF trade, other fees may apply |

| Credit Card (Standard) | Major Issuer | 15%-25% Annual Percentage Rate (APR), $0-$95 annual fee |

| Personal Loan | Bank/Credit Union/Online Lender | 6%-36% APR (varies by creditworthiness and lender) |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Financial literacy serves as a foundational skill for managing personal resources effectively and achieving long-term financial stability. By understanding concepts related to budgeting, savings, debt, credit, investment, and banking, individuals can make informed decisions that contribute to their economic well-being. Continuous learning and adaptation to evolving financial landscapes are key to maintaining a strong financial position in modern life.